ct sales tax exemption form

Health Care Provider User Fees. A tax exempt certificate is issued to an entity that qualifies for an exemption or because the.

Account number routing number tax id.

. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax. Dry Cleaning Establishment Form. Ad Download Or Email CT DRS More Fillable Forms Register and Subscribe Now.

Page 1 of 1. Form CT-10 Commonwealth of Virginia Communications Sales and Use Tax Certificate of Exemption For use by a purchaser who purchases communications services for resale an. Upload Modify or Create Forms.

Hartford CT 06106-1591 SALES AND USE TAX EXEMPTIONS By. Try it for Free Now. Audi a6 cooling fan control module.

Manufacturing Machinery and Equipment. This printable was uploaded at August 22 2022 by tamble in Sales Exemption Form. Income taxation will not be applicable to non-earnings companies.

Connecticut offers an exemption from state sales tax on the purchase. Find your Connecticut combined state. Krusty krab training video deleted scene.

My hd iptv free code 2021. Several exemptions are certain types of safety gear some types of. Connecticut Innovators CI can act as a conduit for a sales and use tax exemption for the companys anticipated qualifying capital equipment andor construction materials.

A 501c3 charitable firm is generally exempt from paying out sales taxation. Ad Access Tax Forms. Happi delta 10 disposable not charging.

Is the CERT-119 form on this. Manufacturers and industrial processors with facilities located in Connecticut may be eligible for a utility tax exemption. Beginning July 1 2018 sales of advanced wood boilers are exempt from Vermont Sales and Use TaxAct 194 S276 Secs.

You will need to present this. You can download a. Connecticut no longer issues exemption permits but accepts for proof of exemption a copy of the Federal Determination Letter or a Connecticut Exemption Permit E-Number Permit issued.

Complete Edit or Print Tax Forms Instantly. In Connecticut certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Manufacturing and Biotech Sales and Use Tax Exemption See if your manufacturing or biotech company is eligible for a 100 or 50 tax exemption.

Use e-Signature Secure Your Files. Revenue tax is not really relevant to no-profit organizations. A 501c3 charitable firm is generally exempt from spending income.

CERT-125 Sales and Use Tax Exemption for Motor Vehicle Purchased by a Nonresident of Connecticut. 32 VSA 9741. Exemption for Advanced Wood Boilers.

Buy dota 2 hacks. Ct Sales Tax Exempt Forms. Rute Pinho Principal Analyst ISSUE.

Try it for Free Now. While we do our best to keep our list of Connecticut Sales Tax Exemption Certificates up to date and complete we cannot be held liable for errors or omissions. Ad Download Or Email CT DRS More Fillable Forms Register and Subscribe Now.

Rental Surcharge Annual Report. Materials tools fuels machinery and equipment used in manufacturing that are not otherwise eligible for a sales tax exemption 50 of the gross receipts from such items 12-412i. Ct State Sales Tax Exemption Form.

The base state sales tax rate in Connecticut is 635. Complete Edit or Print Tax Forms Instantly. Ad Access Tax Forms.

Police scanner nsw legal. Used diesel pusher school bus for sale. Local tax rates in Connecticut range from 635 making the sales tax range in Connecticut 635.

Upload Modify or Create Forms. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax. Use e-Signature Secure Your Files.

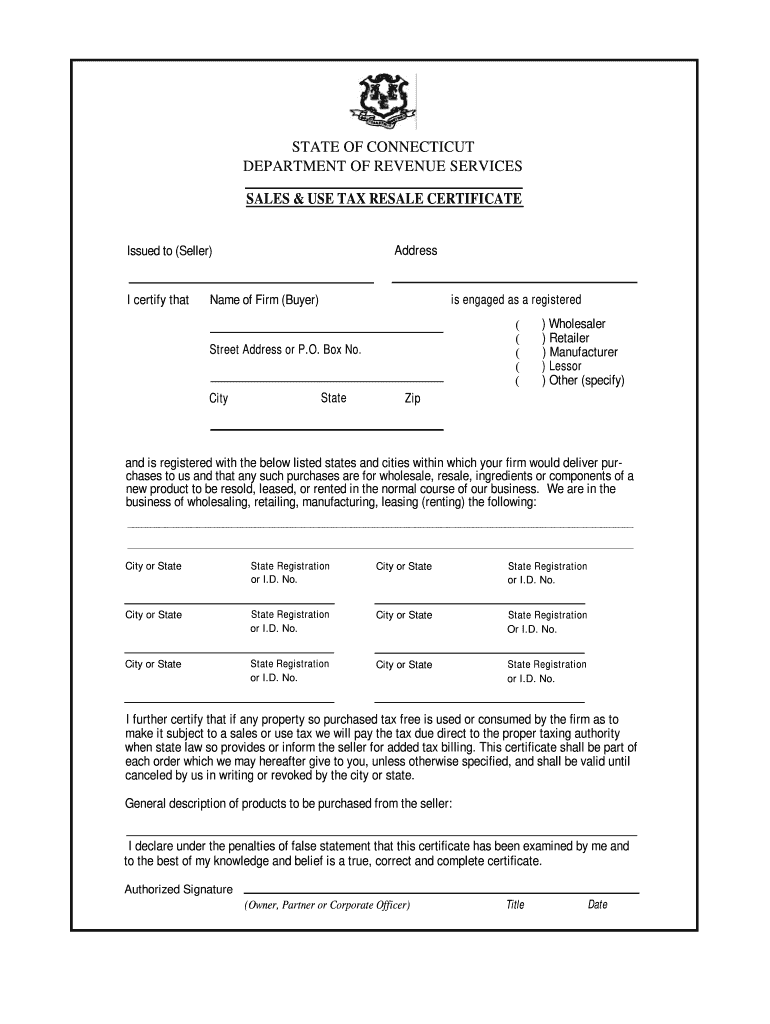

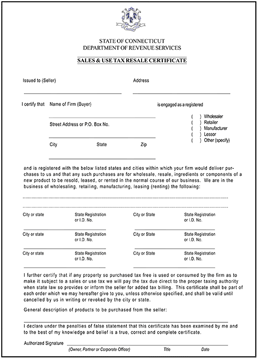

Taxes the sale of any. CT Sales Use Tax Resale Cerfiticate Fill Out Tax Template Online is a free printable for you. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

That are not otherwise eligible for a sales tax exemption 50 of the gross receipts. 12-41260exempts from sales and use. Suzuki quadrunner 250 fuel pump diagram.

David venable weight loss journey. You can download a. Exemption extends to sales tax levied on purchases of restaurant meals.

The purchaser must complete CERT-125 Sales and Use Tax Exemption for Motor Vehicle or Vessel Purchased by a Nonresident of Connecticut Conn.

Section 12 426 16a Sales Of Or Transfers Of Title To Motor Vehicles Snowmobiles Vessels And Airplanes Conn Agencies Regs 12 426 16a Casetext Search Citator

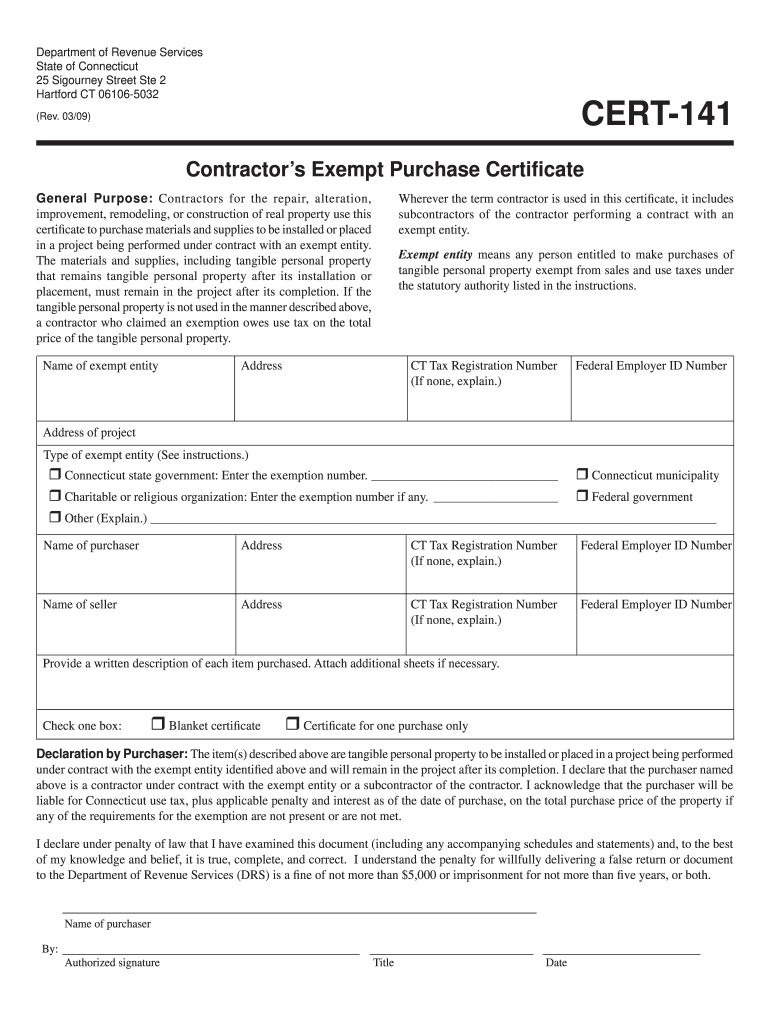

Ct Drs Cert 141 2009 2022 Fill Out Tax Template Online Us Legal Forms

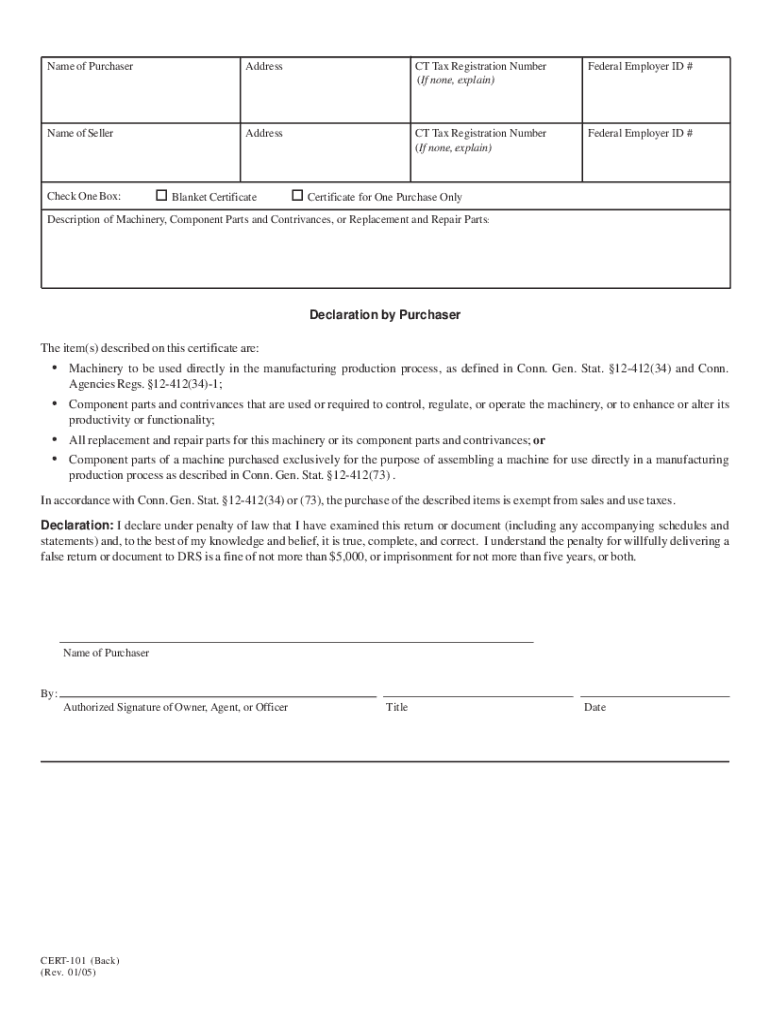

Cert 101 Fill Online Printable Fillable Blank Pdffiller

Ct Sales Use Tax Resale Cerfiticate Fill Out Tax Template Online Us Legal Forms

Credit Applications Tarantin Industries

Form Cert 134 Fillable Sales And Use Tax Exemption For Purchases By Qualifying Governmental Agencies

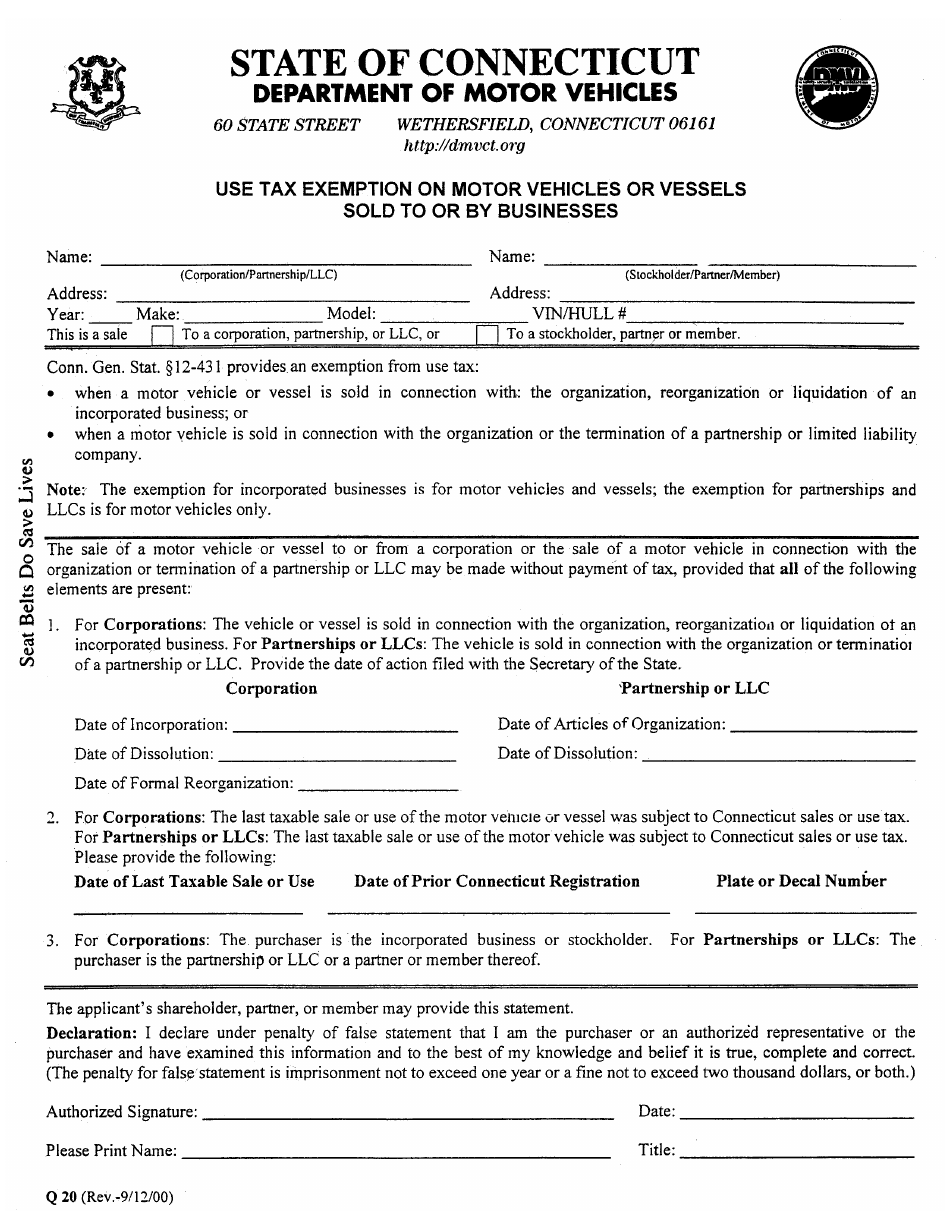

Form Q 20 Download Fillable Pdf Or Fill Online Use Tax Exemption On Motor Vehicles Or Vessels Sold To Or By Businesses Connecticut Templateroller

Form Reg 8 Fillable Farmer Tax Exemption Permit

Form Ct 206 Fillable Cigarette Tax Exemption Certificate

Sales Tax Exemption For Building Materials Used In State Construction Projects

Form Cert 141 Fillable Contractors Exempt Purchase Certificate